santa clara property tax due date 2021

All real estate not falling under exemptions should be taxed evenly and uniformly on a single current market value basis. The median property tax in santa clara county california is 4694 per year for a home worth the median value of 701000.

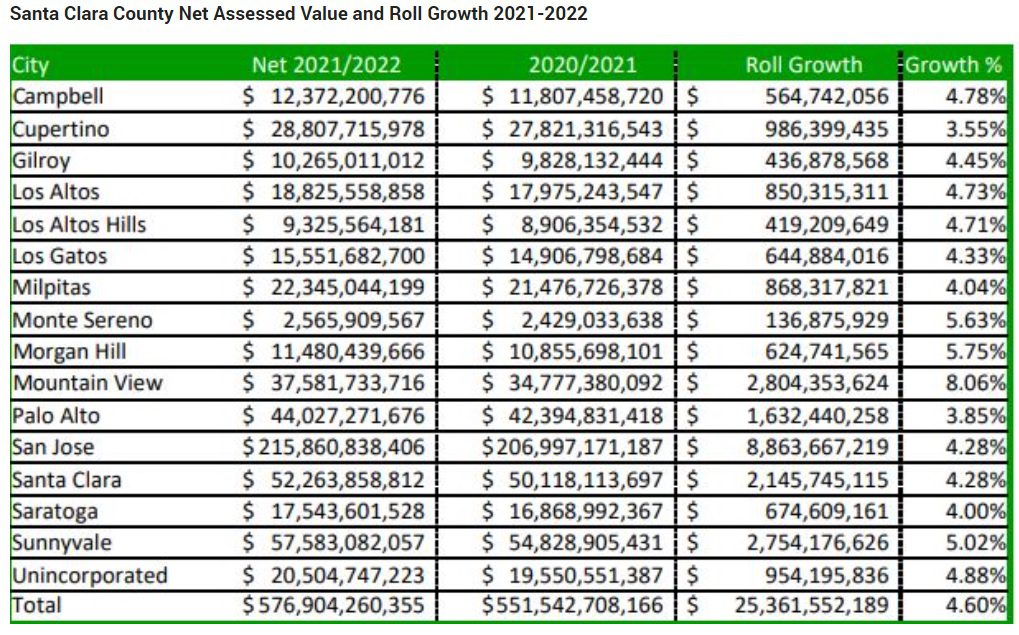

Santa Clara County Sees Increase In Value Of Taxable Properties San Jose Spotlight

First installment of taxes due covers July 1 December 31st.

. The payment for these bills must be received in our office or paid online by August 31. Second Installment of the 2020-2021 Annual Secured Property Taxes Due by April 12 and Becomes Delinquent after 5 pm. Santa clara county property tax due date 2021.

Unsecured bills mailed out throughout the year are due on the date shown on the payment coupon. Assessed values on this lien date are the basis for the property tax bills that are due in installments in December and the following April. The First Installment of the 2020-2021 Annual Secured Property Taxes is due on Monday November 2 2020.

The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property. Based On Circumstances You May Already Qualify For Tax Relief. County of Santa Clara Department of Tax and Collections 70 West Hedding Street East Wing 6th Floor San Jose California 95110-1767 SECURED PROPERTY TAX BILL TAX YEAR.

Owners must also be given an appropriate notice of rate. Ad File a Late 2021 Tax Return Directly to the IRS. The fiscal year for.

April 1 2021 at 1200 PM. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. 0 Federal 1499 State.

Second Installment of the 2021-2022 Annual Secured Property Taxes is Due February 1 and Becomes Delinquent after April 11. County of Santa Clara Department of Tax and Collections 70 West Hedding Street East Wing 6th Floor San Jose California 95110-1767 SECURED PROPERTY TAX BILL TAX YEAR. October 19 2020 at 1200 PM.

Whether you are already a resident or just considering moving to Town Of Santa Clara to live or invest in real estate estimate local. Effective tax rate Santa Clara County 072 of Assessed Home Value California 074 of Assessed Home Value National 111 of Assessed Home Value Median real estate taxes paid. The bills will be available online to be viewedpaid on the same day.

Property taxes are due in two installments about three months apart although there is nothing wrong with paying the entire bill at the first installment. Get your tax refund fast. The bills will be available online to be viewedpaid on the same day.

County of Santa Clara Department of Tax and Collections 70 West Hedding Street East Wing 6th Floor San Jose California 95110-1767 SECURED PROPERTY TAX BILL TAX YEAR. Business Property Statements are due April 1. The due date to file via mail e-filing or SDR remains the same.

January 22 2022 at 1200 PM. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals.

The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021. Learn all about Town Of Santa Clara real estate tax. If Date falls on Saturday Sunday or Legal Holiday mail postmarked on.

However assistance is available to. File your 2021 taxes even if you missed the deadline.

Property Tax Calculator Smartasset

Industry News Invoke Tax Partners

2022 Taxes Due Deadlines Refunds Extensions And Credits This Year

California Property Tax Calendar Escrow Of The West

Ca Santa Clara County Rfp 2017 Prison Phone Justice

Property Tax Calculator Smartasset

Santa Clara County Business Owners Can Seek Property Tax Relief

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

Santa Clara County Office Of The Assessor Facebook

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Property Taxes Due Dec 10 In Napa County Bay Area Napa Valley Ca Patch

Property Tax California H R Block

First Installment Of The 2021 2022 Annual Secured Property Taxes Due By December 10 And Becomes Delinquent After 5 P M The Bay Area Review

Andrew Crockett Health Care Financial Analyst Ii County Of Santa Clara Health System Linkedin

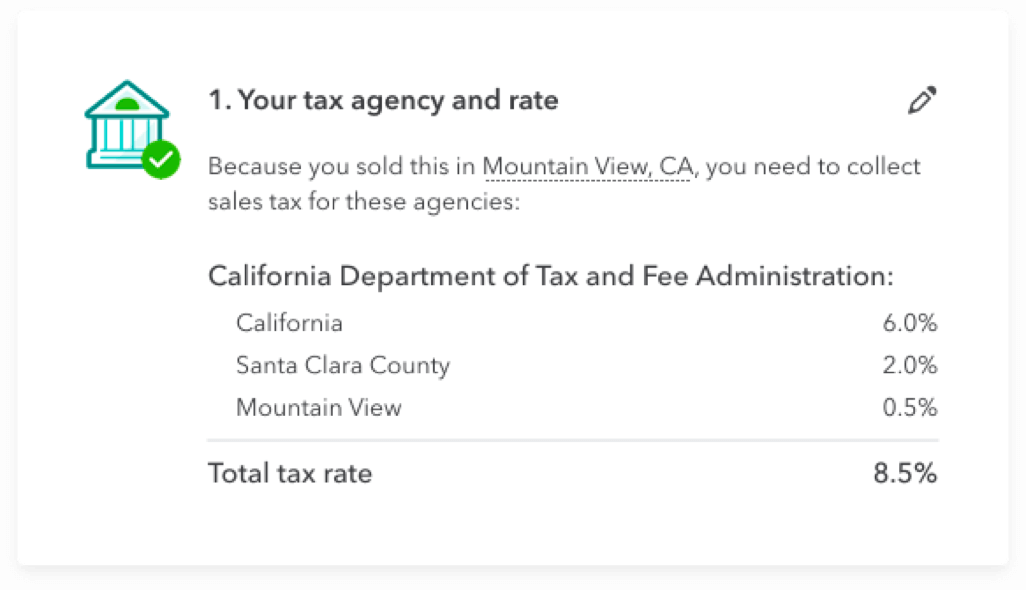

Manage Sales Taxes Mileage And Receipts Quickbooks Online Advanced